Our Beliefs

We’re creating a new era in revenue cycle management driven by three core beliefs.

Comprehensive automation is the future.

A system-level view is essential.

Real-time adjudication is within reach.

Introducing

Phare: Healthcare’s First Revenue Operating System

-

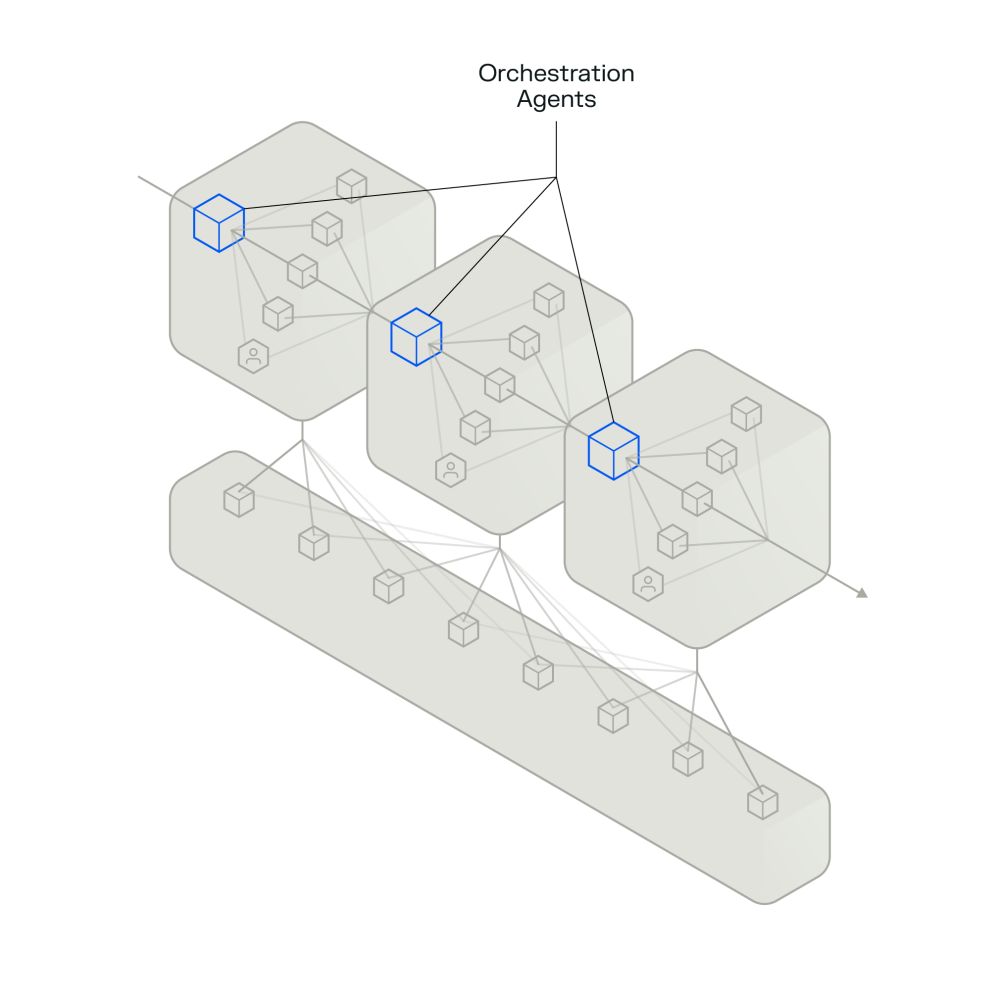

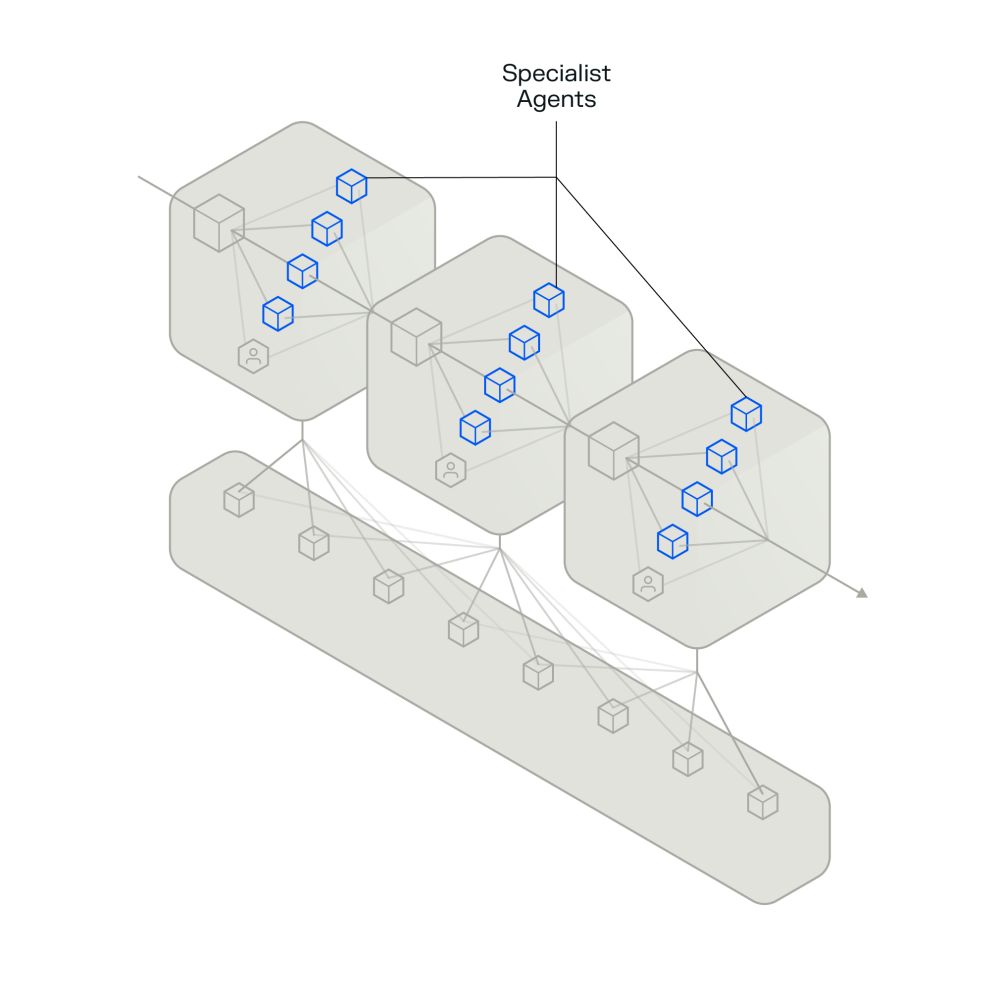

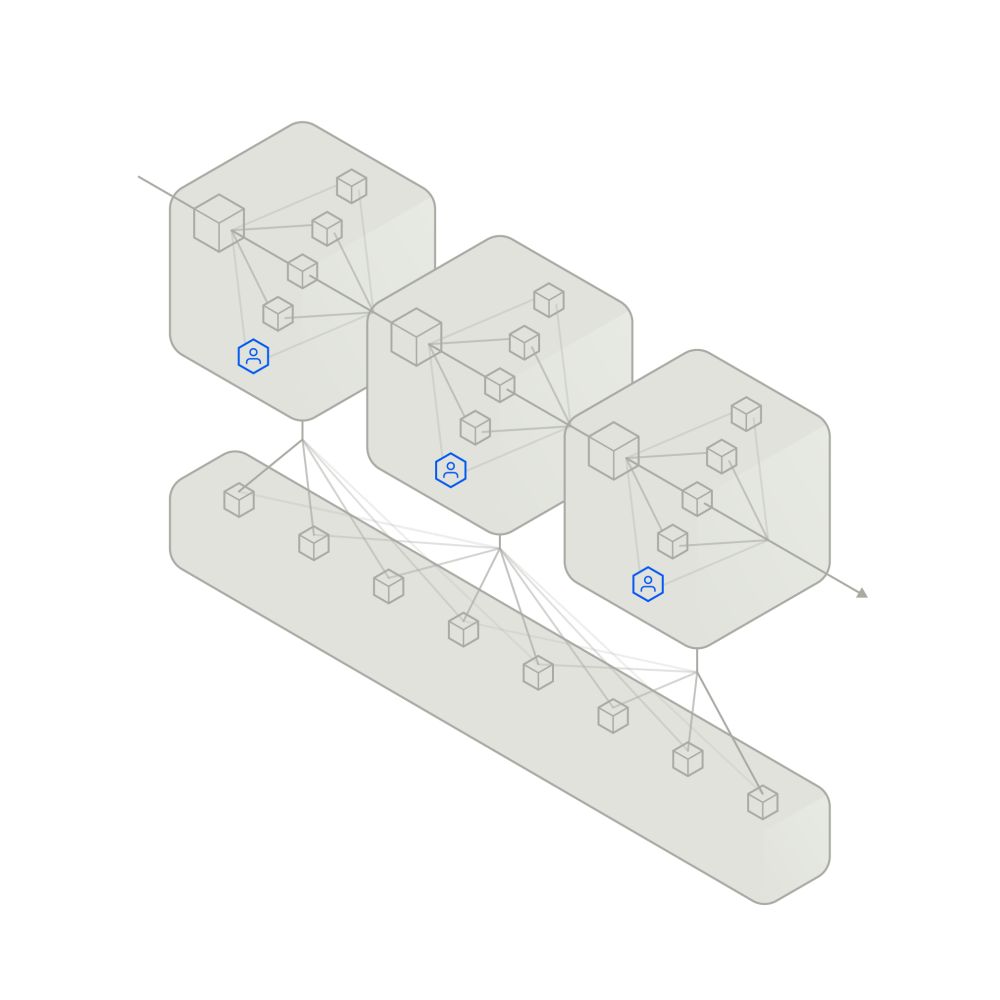

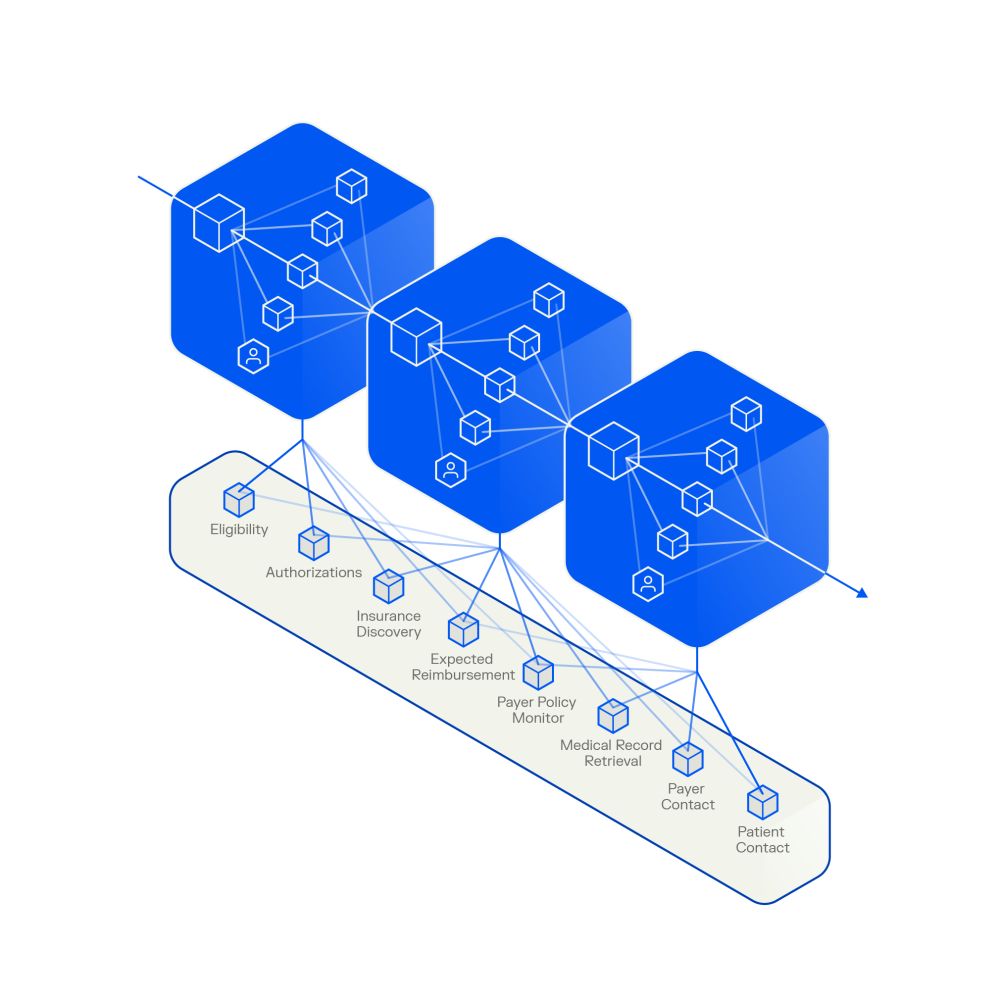

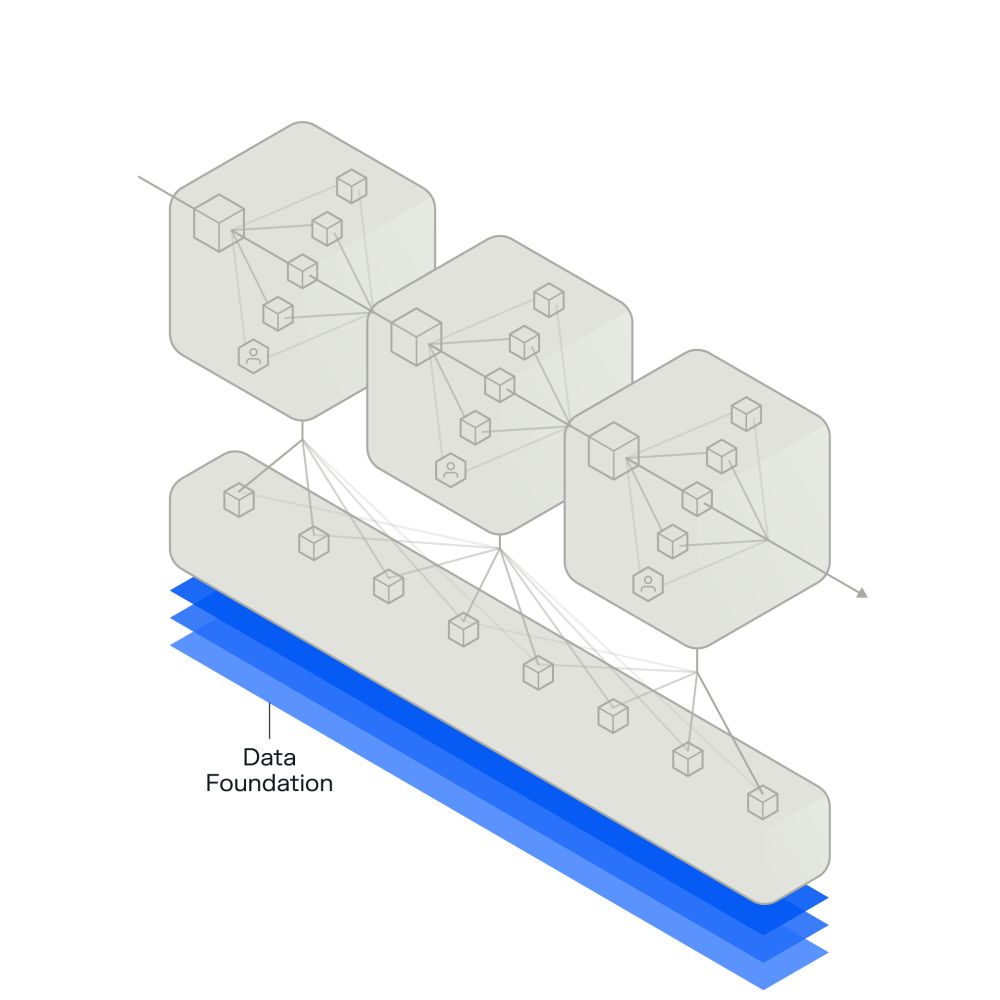

Phare is a platform that automates complex work through an integrated agentic system.

Our Products

Our enterprise-grade AI products deliver transformational outcomes.

Our engagement models meet you where you are.

Operating partnerships

Agentic solutions

R1's AI Lab

R37 is building technology that’s transforming the unit economics of healthcare.

An innovation engine

R37 is R1’s AI lab to transform healthcare financial performance. Our dedicated team of technologists and revenue cycle experts identify, build and scale AI solutions aimed at achieving comprehensive automation and moving the industry to real-time adjudication.

We utilize reasoning, language, voice and capture use models to build AI agents that are deployed as part of an integrated system. This system optimally allocates work between autonomous agents and humans. The results are increased revenue, reduced costs and faster throughput.