In the United States, an estimated 43 million people hold a total of $88 billion in medical debt on their credit reports. Patients often incur these expenses unexpectedly, leading to high rates of bankruptcy. Now, healthcare organizations are facing increased scrutiny over patient billing and collection practices.

The Consumer Financial Protection Bureau signals increasing scrutiny over medical debt billing and collection practices

The Consumer Financial Protection Bureau (CFPB) was established under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 with the goal of protecting consumers from unfair, deceptive or abusive practices relating to financial matters. In 2014, the CFPB published its first study on the challenges patients face when their medical debt is reported to one or more of the three largest nationwide consumer reporting agencies (NCRAs). The report identified that the chief consumer complaint was the lack of prior knowledge surrounding medical debt, due in part to the complex and fragmented nature of the healthcare billing and claims adjudication process.

The report goes on to highlight a 2014 Data Point study finding that the presence of medical debt on a consumer’s credit report is not a reliable predictor of future delinquency compared to other types of reported debts, such as credit card debt. As a result, the CFPB implemented more stringent reporting requirements for creditors, collection agencies and credit bureaus to ensure the accuracy of medical debt data in consumer credit reports. The Bureau has continued monitoring complaints and issuing enforcement actions against creditors and collection agencies who collect and furnish inaccurate medical debt data. Even with ongoing enforcement, the level of scrutiny the CFPB has applied over the past several months is unprecedented.

On January 13, 2022, the CFPB released a medical debt compliance bulletin warning creditors and debt collection agencies who furnish information to NCRAs that they could face significant legal liability under the Fair Debt Collection Practices Act and the Fair Credit Reporting Act if they attempt to collect or report medical debts exceeding the amounts providers are permitted to charge under the newly enacted No Surprises Act.

A few weeks later, the Bureau issued a 54-page report on the prevalence and magnitude of past-due medical debt. The report demonstrated that current practices in medical debt collections and reporting may cause significant harm to consumers. Notably, the report found that patients and their families routinely have trouble navigating healthcare organizations’ payment assistance programs and that healthcare organizations frequently coerce patients, through threats or actual credit reporting, into paying inaccurate amounts towards their medical bills.

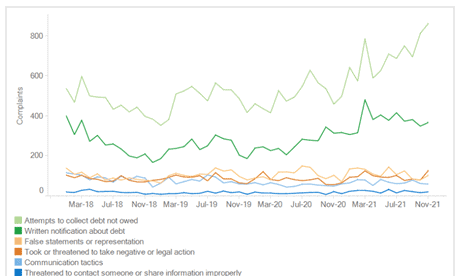

Medical debt complaints data from the CFPB’s Consumer Complaint Database, 2018-2021

Taken together, these findings led the Bureau to determine that including medical debt on consumer credit reports threatens the integrity and accuracy of the credit reporting system, creating inefficiencies for both patients and creditors.

The CFPB’s emphasis on combatting the current medical debt crisis appears to have caught the attention of the NCRAs. In March 2022, the three leading NCRAs announced major changes to how they will report medical debt on consumer credit reports. While the NCRAs expect these changes will eliminate nearly 70% of medical debt tradelines from consumer credit reports, it is unlikely that these joint measures will be sufficient to assuage the CFPB. The Bureau’s renewed focus, heightened by the impact of the ongoing COVID-19 pandemic, signals that the CFPB will continue to double down on enforcement efforts to protect consumers from flawed credit reporting.

The Biden administration’s plan to alleviate medical debt burdens

The Biden Administration issued a statement on April 11, 2022, announcing the White House’s plan to help ease the burden of medical debt and increase consumer protections for patients and their families. The plan supports a recent executive order from President Biden calling for increased access to affordable healthcare coverage and directs the Department of Health and Human Services (HHS) to evaluate, identify and eliminate predatory medical billing practices. To that end, HHS will begin collecting data from more than 2,000 healthcare organizations to assess their patient billing, collections and financial assistance program policies. Hospitals and providers should expect further guidance and policy recommendations from HHS that directly impact their billing and collection practices and intensified scrutiny from enforcement agencies for any potential violations.

Medical debt reform and the future of patient billing and collections

At the federal level, congressional efforts are underway targeting abusive medical debt collection practices. The Comprehensive Debt Collection Improvement Act (H.R. 2457) passed by the US House of Representatives would prohibit the collection and reporting of medical debt arising from medically necessary procedures for a two-year period after services are rendered.

Across states, initiatives to expand financial protections for consumers are growing, as is public support for model state laws protecting patients from medical debt. At least 18 states have enacted laws restricting medical debt collection practices, including limitations on interest rates and requirements on the timing and procedures for assigning medical debt to a collection agency.

The growing medical debt crisis and heightened regulatory scrutiny on providers will require healthcare organizations to critically examine their own billing and collection practices. Billing is a vital piece of the patient experience and when patients are unaware of their financial obligations or have concerns about their ability to pay, it can dissuade them from pursuing care and adversely impact their physical and financial health. As such, healthcare organizations should consider refocusing their efforts to improve the patient experience through upfront financial navigation solutions that provide patients with transparent information on treatment costs, financial obligations and payment options. Healthcare organizations should also work cross-functionally to reduce claims processing friction that could ultimately result in patients receiving unexpected bills (for example, failure to obtain required prior authorization for services).

R1 is your strategic partner

R1 Patient Bill Pay technology has helped simplify and personalize the patient financial experience by providing bill pay technology patients are comfortable using. This technology consolidates bills, financial plans and payments for the entire household on an intuitive online platform and is connected from pre-service to post-service, making it easy for patients to navigate. Provider estimates are automatically shared with patients upon scheduling, resulting in pricing transparency so patients know what they owe and can make payment arrangements.

R1 understands the increasingly complex regulatory environment and the related challenges our customers experience navigating these issues. In response to customer feedback, R1 is excited to announce its newly established Regulatory Affairs function under the Advisory & Assurance group. This group will be responsible for monitoring legislative and regulatory changes that impact the revenue cycle and communicating actionable regulatory intelligence to operations and our customer partners. Additionally, the group will be responsible for proactive outreach to regulatory agencies to educate and advocate for policies that align with our mission — to reduce the friction that’s holding healthcare back and improve the patient financial experience.

Key takeaways

- Aggressive collection practices by debt collection agencies are leading to increased government agency scrutiny.

- The CFPB is rolling up its sleeves to issue regulations and enforcement actions on patient billing and collection practices.

- Healthcare organizations should focus on centering the patient experience through upfront financial navigation solutions.

- R1 Regulatory Affairs actively monitors legislative and regulatory changes and communicates actionable regulatory intelligence to operations and our customer partners.

Disclaimer: This blog is for educational purposes only and is current as of June 16, 2022. Not intended to be used as or constitute legal or medical advice. Our statements are on behalf of R1 only and, in turn, are not intended to reflect or otherwise represent the viewpoints or positions held by R1 customers. This article contains predictions on future trends in healthcare, including on regulations not yet published. Readers are cautioned not to place undue reliance on such predictions.

Author bio: Content written by R1’s Regulatory Team